The golden cross is a bullish breakout pattern that can signal the beginning of an uptrend. This happens when buying pressure starts to outweigh selling pressure, and indicates that the market may begin to trend upward. On the other hand, when a shorter period EMA crosses below a longer period EMA, it signals a potential bullish reversal.

This happens when sell pressure starts to outweigh buying pressure, and indicates that the market may begin to trend downward. When a shorter period EMA crosses above a longer period EMA, it signaled a potential bearish reversal. What happens when 100 EMA crosses 200 EMA These moving average crossover strategies can be useful in identifying potential trend changes in a stock. The golden cross occurs when the 50-day moving average crosses above the 200-day moving average and can signal the end of a downtrend. This can signal that downward momentum is exhausted and that the stock may be due for a move higher. The death cross appears on a chart when a stock’s short-term moving average, usually the 50-day, crosses below its long-term moving average, usually the 200-day. The death cross and golden cross are important technical indicators for traders to be aware of. The EMA indicator is regarded as one of the best indicators for scalping since it responds more quickly to recent price changes than to older price changes. The indicator is based on crossovers and divergences of the historical averages. The EMA indicator is a technical indicator that is used by traders to obtain buying and selling signals. A golden cross signals a potential buying opportunity, while a death cross signals a potential selling opportunity.

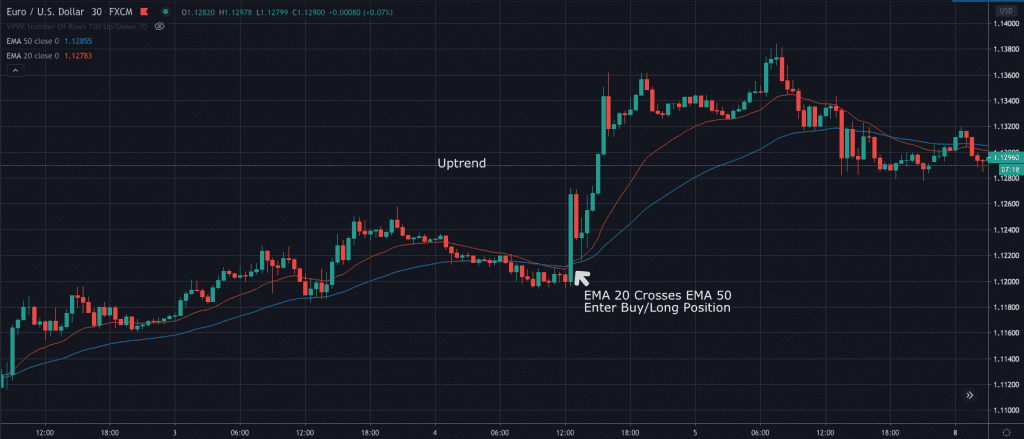

Plotting one EMA with a short time frame and another with a longer time frame can help to identify these crossovers. The trading rules are to buy when the EMA 12 crosses above the EMA 50 and the price is above the EMA 12.Ĭrossovers between different EMAs can be used to signal potential reversals in the market. The strategy uses the 12 day and 50 day Exponential moving averages (EMAs). This is a simple trend following strategy that uses moving average crossovers. In this case, the 20-day exponential moving average is greater than the longer-term 50-day exponential moving average over a roughly seven-month period, indicating an already bullishly trending stock price. What does it mean when the 20 day moving average crosses the 50 day moving average

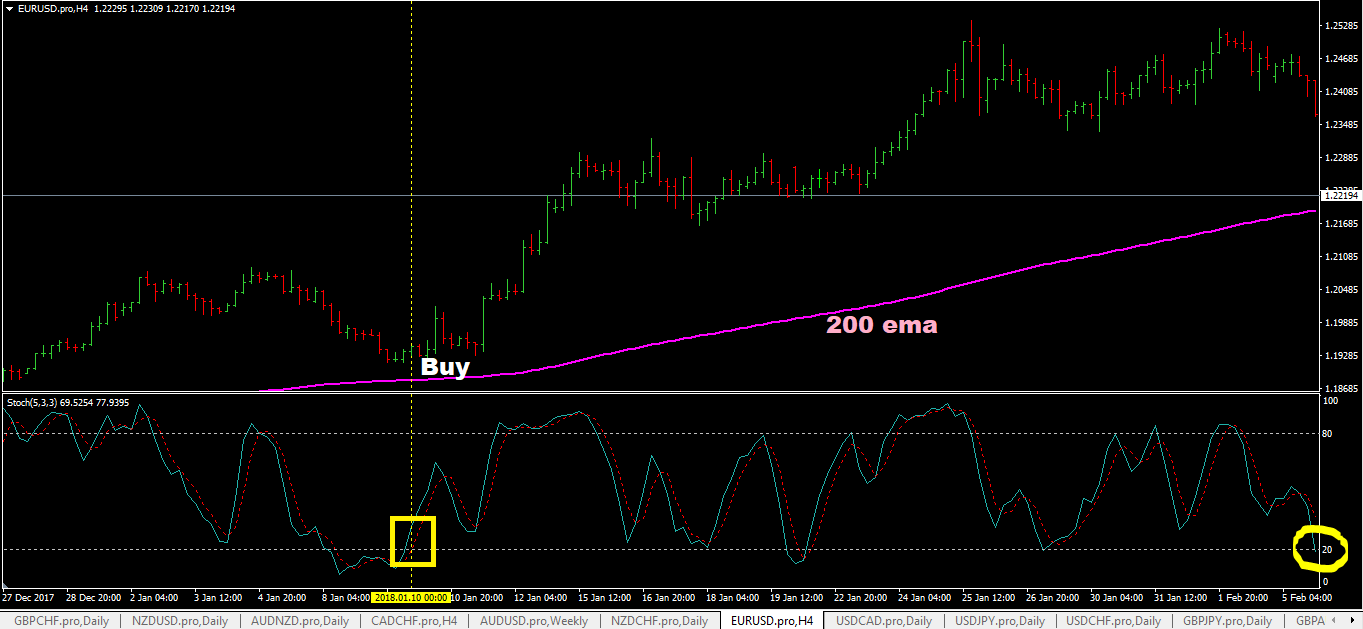

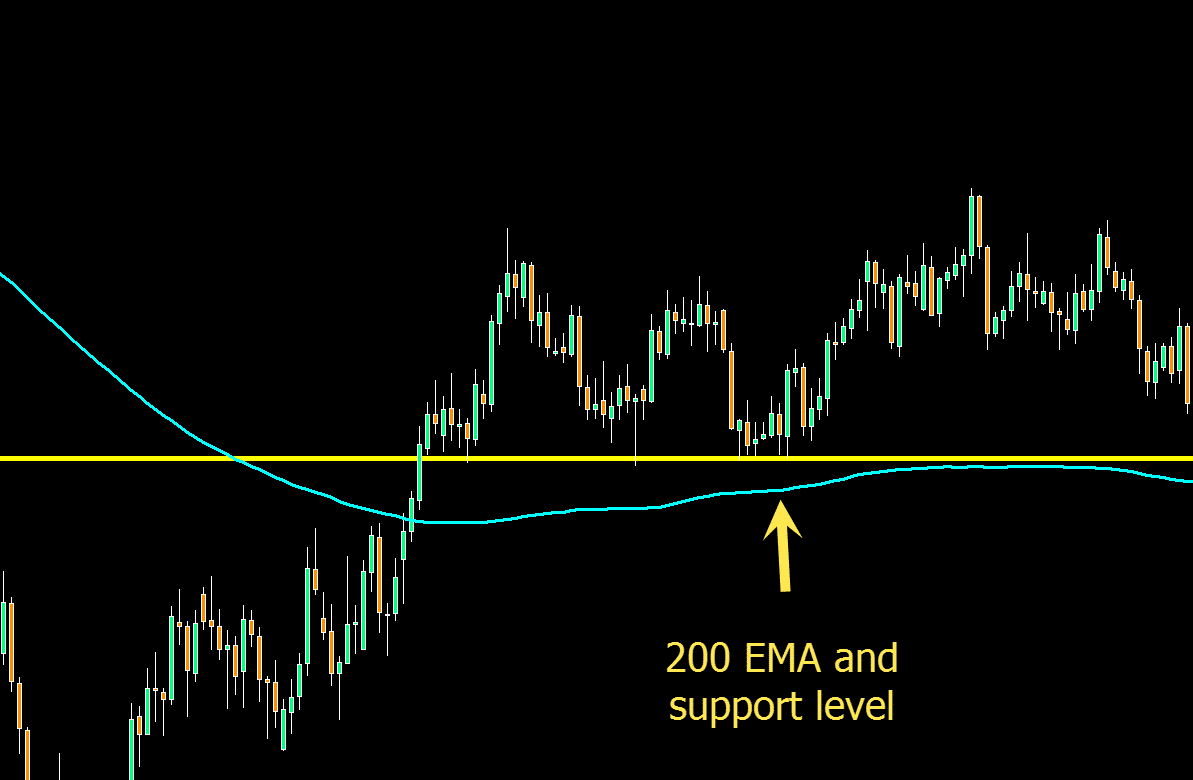

An upward crossover or golden cross is alleged to possess similar magic properties in establishing a new uptrend. The downward crossover of the 50-day EMA through the 200-day EMA signals a death cross that many technicians believe marks the end of an uptrend. The strategy is to buy when the 20-period EMA crosses above the 50-period EMA, and to sell when the 20-period EMA crosses below the 50-period EMA. Investing in or trading crypto assets comes with a risk of financial loss.What does it mean when the 50 EMA crosses the 20 EMA? The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Resistance – $ 5.812 and $6.493 Disclaimer Although it did try to make a retest, sellers overpowered the market and made a 21% bear run. However, it proved to be a bear trap as after failing to sustain above those levels FIL made a three black crow pattern and broke below the 200 EMA with strong momentum. ConclusionĪlthough after taking rejection from the $9.00 FIL lost 30 percent of its value falling below the price of $6.600 after falling near the 200 EMA it tried to sustain above those levels by making an engulfing candle which is a bullish candle and often found before a bull trend. The RSI curve is suggesting that it might attempt to break above the 14 SMA. The RSI line is currently trading around 35.03 points while taking resistance from the 14 SMA line which is trading around 45.95 points near the median line. The RSI line is currently trading in the oversold zone in a downtrend.

0 kommentar(er)

0 kommentar(er)